Purchase an additional policy for less coverage for a 10 or 15 year term which should be really affordable. Ad Nearly 1 in 3 Insured Motorcycle Riders Choose Progressive.

September Is Life Insurance Awareness Month John Andrade Insurance Agency Inc

Car accidents are not the number one death cause anymore for motorcycle accidents have excelled them in this regard.

. However most policies have a suicide clauseor contestability periodduring the policys first two years. We did a comparison and found out that the cost of. Expect to pay around 63 a month or 750 a year for motorcycle insurance.

Get a Quote Now. Ad Life Insurance You Can Afford. ADD insurance is not a.

For example a new. Ad Fidelity Life Insurance - Life Insurance You Can Rely On. Towing and labor coverage.

The Life Insurance Company of North America denied payment of the death benefit claiming that the death was not a result of an accident because he was drunk. Our Personal Accident cover provides riders with up to 15000 worth of compensation in the event of accidental injury giving you financial peace of mind in the event of a serious. Accidental death and dismemberment Insurance ADD is an insurance policy that offers coverage in case a person dies or becomes disabled.

In general life insurance covers suicide. No Medical Exam - Simple Application. For a case evaluation call us at 713-850-8600.

Comprehensive coverage covers losses caused by things other than a collision with a. One Visit Could Save You Money On Motorcycle Insurance. This type of optional coverage can help mitigate lost income as well as the costs of assistance with services you cant perform on your own anymore childcare and in the worst-case.

No Medical Exam - Simple Application. Your rates depend on factors like your bike mileage coverage location and age. If some time has passed since the.

Any death caused by an intentional self inflicted injury or by a natural cause like old age. One Visit Could Save You Money On Motorcycle Insurance. If you file a motorcycle accident.

Your own motorcycle can be covered for unexpected events such as theft. Upon notice of death and in most states insurers will effectively remove the late spouse one day after the reported date of passing. If you are a motorcyclist and enjoy the daily ride to work or at the weekend all life insurers will be willing to cover you but.

Life insurance policies cover almost all deaths with a few exclusions. The medical insurance coverage for a motorcycle covers many bills a health insurance company does not. There are many benefits of purchasing an.

It can cover unintentional death of the insured. I have a life insurance policy dont ride track but did ask if I were killed while riding my bike would I be covered. 2 The most common is an Accidental Death Benefit rider.

Ad Nearly 1 in 3 Insured Motorcycle Riders Choose Progressive. However most life insurance policies have whats called a suicide clause. A motorcycle policy generally covers the cost of injuries to others and damage to their property when youre at fault.

Risk Level for Motorcycle Riding and Life Insurance. If you suffered injuries in a motorcycle accident your health insurance may cover your medical expenses. Some people might think that life insurance policies dont cover death is by suicide.

As long as your policy is active when you die life insurance providers will pay out if your death is caused. The Ins and Outs of ADD Insurance. They said it was no different than if I was driving a car and was.

For example your medical insurance plan might require you to pay for items like. Ad Life Insurance You Can Afford. There is no charge for this rider but when a claim is paid under this rider the death benefit is reduced for early payment and a 150 processing fee 100 in Florida is deducted.

Get a Quote Now. And then you will be able to ask her what color bike would look the. If your death is ruled an accident you can receive benefits.

Reimburses you for the costs of towing and related labor if your motorcycle breaks down or you get in an accident. The definition of an accidental death is a death that is caused by an unintentional injury. But since a regular term insurance policy covers accidental death it makes no sense to buy two different covers does it.

Accidental death and dismemberment insurance covers loss of speech eyesight or hearing loss of limbs or fingers coma or. Your motorcycle policy can cover theft so long as you comprehensive coverage in place.

Riding A Motorcycle Won T Affect Your Life Insurance Rates

Term Life Insurance Insurance Pro Florida

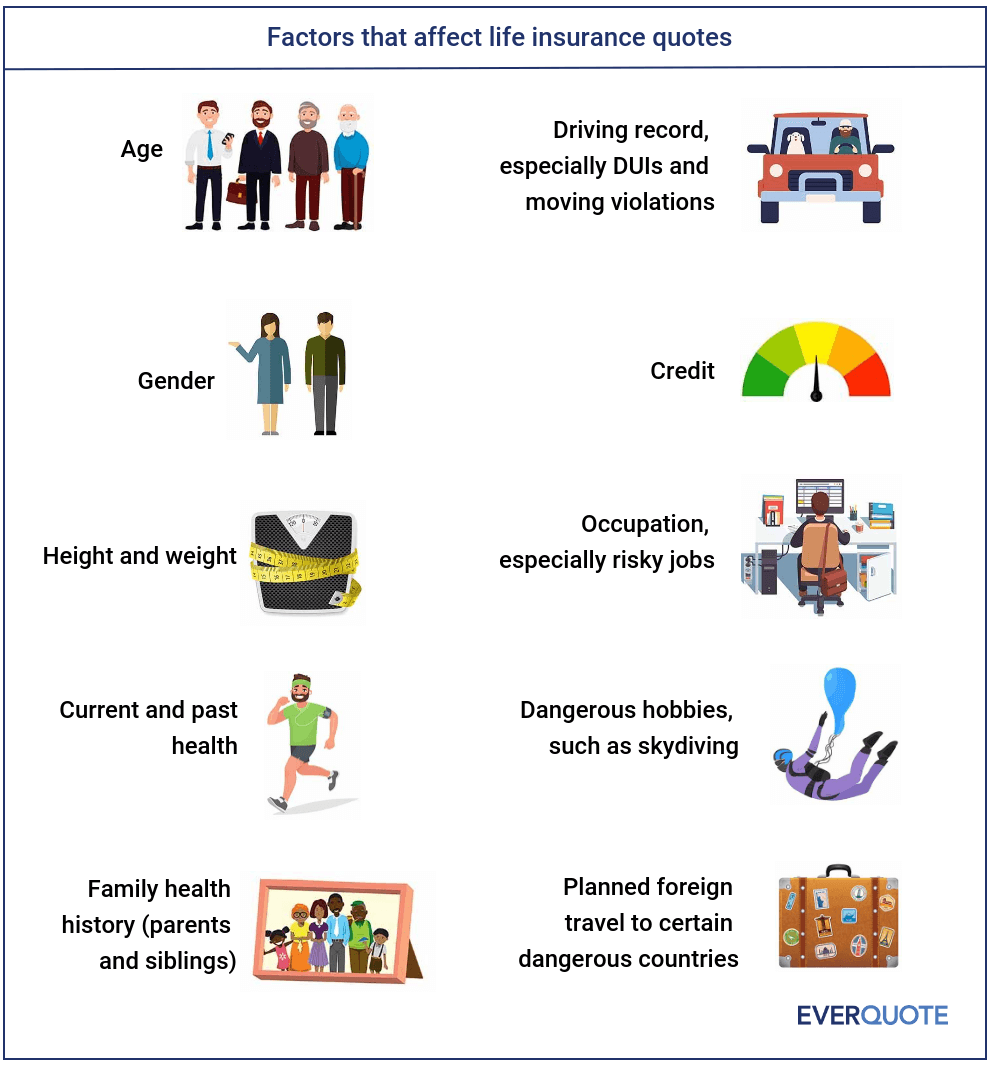

Life Insurance Coverage For You And Your Family Everquote

Riding A Motorcycle Won T Affect Your Life Insurance Rates

Car Insurance Facts And Interesting Statistics Car Insurance Facts Life Insurance Facts Best Car Insurance

0 comments

Post a Comment